Diving into the realm of day trading presents a thrilling challenge. Success in this fast-paced market demands quick reflexes, meticulous analysis, and a deep understanding of market mechanics. Scalping, a strategy that focuses on making small profits from short-term price fluctuations, stands as a favored technique among day traders. It demands an ability to spot fleeting market movements and execute trades swiftly.

Mastering| your scalping skills involves several key components. Starting with, you'll need to select a suitable market and timeframe that aligns with your trading style. Then|, familiarize yourself with the technical analysis tools and indicators that can help you predict price action.

- , Additionally, a robust trading infrastructure is essential for executing trades promptly

- , Lastly, develop a solid trading plan that includes a framework for trade management

Always bear in mind that scalping carries inherent risks, and it's essential to manage your risk effectively. Start with a demo account to hone your skills before click here risking your hard-earned money.

Unlocking Intraday Opportunities: Mastering Technical Analysis

Intraday trading can be a thrilling endeavor, requiring sharp focus and refined decision-making. To navigate the volatile waters of the market successfully, mastering technical analysis is indispensable. This involves decoding price charts, patterns, and indicators to identify potential trading setups. By understanding these market signals, traders can leverage intraday fluctuations for profit.

- One key aspect of technical analysis is identifying support and resistance levels.

- Trendlines provide valuable insights into the direction of price movement.

- Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), can highlight overbought or oversold conditions.

By utilizing these techniques, traders can improve their ability to make informed trading decisions. However, it's important to remember that technical analysis is not a foolproof system and should always be used in conjunction with sound risk management practices.

Trading Tactics: Level Up Your Day Trading

Embarking on the journey of day trading requires a strategic approach, whether you're a novice or a seasoned veteran. Quantitative analysis forms the bedrock of profitable day trades. Beginners should start by mastering key concepts like price action, candlestick patterns, and support/resistance levels. They can utilize simple strategies like scalping or breakout trading to earn small profits. As traders progress, they can delve into more advanced techniques, such as momentum trading, arbitrage, and news trading.

Keep in mind that day trading is highly risky, and consistent profitability requires continuous learning, discipline, and risk management. Develop a solid trading plan, rigorously test your strategies, and always trade with extra capital than you can afford to risk.

- Understand well technical indicators and chart patterns.

- Execute your strategies on a demo account before risking real money.

- Keep abreast of market news and economic events.

- Manage risk effectively by setting stop-loss orders.

Navigating the Mental Game of Day Trading

Day trading necessitates a unique blend of analytical prowess and emotional discipline. While technical indicators and market analysis provide the framework, it's the trader's psychological state that frequently determines success. Developing a mindset focused on risk management and psychological equilibrium is paramount to navigating the turbulent world of day trading.

- Employ clear risk-management strategies, setting defined stop-loss orders to limit potential deficits.

- Adopt a journaling practice to track your trading decisions, identifying behavior in both winning and losing scenarios.

- Nurture patience and stay away from impulsive trading decisions driven by fear or greed.

Bear in mind that day trading is a marathon, not a sprint. Consistent success comes from making calculated decisions based on sound research, while preserving emotional stability.

Building Your Day Trading Edge: Tools and Techniques

Day trading success hinges on leveraging tools and techniques that give you a competitive boost. This means scrutinizing market data with precision, placing trades swiftly, and mitigating risk effectively. A robust trading platform is your cornerstone, providing real-time quotes, charting tools, and order execution capabilities.

Supplement this with technical indicators like moving averages, RSI, and MACD to uncover potential trading opportunities. Fundamentals matter too; stay informed about industry news that could impact your positions. Develop a trading plan outlining your strategy, risk tolerance, and entry/exit points.

Perpetually educate yourself on market trends, refinement your skills through practice, and always adapt your approach based on experience and market conditions.

Live Like a Trader, Win Like a Trader

To truly/authentically/genuinely master the art of trading, you must immerse/inhabit/integrate yourself in its dynamics/rhythms/nuances. It's not just about studying charts and executing/implementing/deploying strategies; it's about cultivating/developing/honing a trader's mindset/trading mentality/market consciousness that embraces/accepts/welcomes both victory/success/triumph and defeat/loss/setback.

- Embrace/Welcome/Adopt calculated risks/chances/leaps with confidence/assurance/certainty.

- Discipline/Focus/Rigor your thoughts/actions/decisions to align/match/mirror market signals/indicators/trends.

- Continuously/Perpetually/Relentlessly learn/study/evolve from both your wins/successes/victories and your losses/failures/setbacks.

This isn't a sprint; it's a marathon/journey/process. Forge/Sculpt/Mould your path with patience/perseverance/tenacity and you'll unlock/uncover/reveal the true potential of trading.

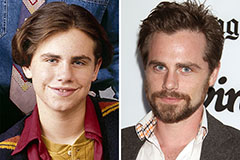

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Rider Strong Then & Now!

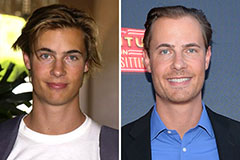

Rider Strong Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!